Release liners: The next step

13 March 2008AWA's annual global release liner conference addressed issues such as rising costs, reducing profitability and environmental concerns

The Global Release Liner Industry Conference, hosted annually by AWA Conferences & Events, took place in Amsterdam, The Netherlands, last month. More than 150 delegates got together to focus on the opportunities and concerns in a business which has seen considerable consolidation in recent years, and is facing up to rising costs, reducing profitability, and environmental issues. A special feature of this year's agenda was an invitation from Loparex for delegates to visit its facility in Apeldoorn.

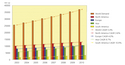

Opening the formal conference proceedings, conference chairperson Corey M Reardon, president and ceo of AWA Alexander Watson Associates, provided a global update on the release liner market as a whole. North America is still the largest geographical market at 37 per cent, he said, with Europe in second place at 30 per cent but across nearly all applications, these are mature markets, and growth is slowing. Asia Pacific's current share, 25 per cent, is, however, likely to increase significantly: annual growth of nearly 10 per cent means that the region will soon overtake the traditional market leaders in terms of volume usage.

Overall, AWA forecasts a continuing annual growth rate for the industry of 4-6 per cent, but Corey Reardon drew delegates’ attention to a real concern. He said: “We must not forget that the release liner industry is a producer of waste material after a self adhesive application is completed. As it positions itself for the future, this becomes more and more of a critical issue.”

Less transactions, more partnership

A second keynote presentation from Alexander van 't Riet, business line director for films at Avery Dennison Roll Materials Europe addressed suppliers, growth, and customer needs from two perspectives: that of a purchaser of release liner, and that of a leading self adhesive laminate producer. His premise was challenging: the customer's agenda, he said, is 'ME, everything, now' - a wish list that highlights a genuine need for supply chain partnerships. To grow the self adhesive industry, he said, suppliers have a key role in developing cost effective, innovative solutions in support of the multi-generation product plans.

Globalization continues apace in release liner as elsewhere. Penti Kallio, ceo of the largest commercial release liner producer worldwide, the Loparex Group, looked at drivers and challenges. In the labelstock market today, he showed, 50 per cent of customers are global, and 50 per cent local. In the hygiene, tapes, medical, and graphic arts markets, most of the business is now global. However, he said, even global customers want local service.

Penti Kallio enumerated the risk assessment criteria for globalization as economical and political uncertainty, local competition, time perspective, internal challenges and strategy, for example, the choice of a stand-alone or joint venture. He observed: “Few manufacturers are able to globalize with their current company structure.” He stressed that it could take a long time to achieve ROI and that the local competition should never be underestimated.

Platinum challenges

Central to both the success and the problems associated with release liner is the catalyst, platinum. It was the subject of a joint presentation from Wolfgang Wrezesniok-Rossbach, head of marketing and sales, Precious Metal Trading, from metal supply and financial hedging services experts Heraeus, and Norm Kanar, release segment team leader from Dow Corning. Platinum prices reached an all-time high in 2008. Platinum demand has exceeded supply for the last nine years and is now in deficit with only 205t mined in 2007. Low platinum systems and a changed chemical architecture are the answer for silicone coating, Norm Kanar observed, and concluded that “thermal solventless silicones will be the system of choice”.

Environment and sustainability

UPM-Kymmene's vp of environmental affairs and corporate social responsibility, Marja Tuderman, demonstrated a route to a successful, holistic environmental approach to paper release liner. She identified the current environmental action points: climate change mitigation, the scarcity of fresh water, unacceptability of landfill and opportunities for waste recovery, minimizing chemical usage, and sustainable sourcing. Success, she said, demands that the emphasis must be on reducing the total environmental impact of the product or operation, not just one aspect.

The final keynote presentation on the opening day of the conference was a fresh and thought provoking view of the sustainability agenda from a major end user. Steph Carter, packaging sustainability director at Unilever, made a strong case for sustainability metrics, discussing what, how, and why every company should indeed embark on such a procedure. “Until you have the measures”, he said, “you can’t set the targets!” He debunked the popular myth that reductions in packaging are the answer to everything. “It is important to consider the way the product is used by the end user. Never consider just one part in isolation when accounting for the impact of packaging,” he said. When selecting packaging for specific applications, he counselled, “it is wrong to choose materials simply because they have the lowest impact, or are perceived to be ‘green’. Choose them for function and their real impact, not the perception.” He cautioned that release liner, like any aspect of product processing which the consumer does not see, is likely to become a bigger issue in the consumer arena in the future.

Success in a consolidated group

Neil Burns, md of Mondi Coating & Release’s Release Liner Segment, opened proceedings in the marketing forum, with a manufacturer's viewpoint of an industry where, he said: “If you talk to a buyer, don't be surprised if price is top of the list of topics!” Explaining the corporate Mondi context, he showed how the company's acquisitive trail in recent years has created both internal challenges and opportunities at all levels. In what is now a highly diversified group culture, Mondi nevertheless underlines, in a converting business, the importance and value of maintaining decentralized management. He summarized some of the questions companies need to ask themselves before defining their future actions, all of which are underpinned by a key statement: 'No product development, no future'.

Growing markets

Drilling down into regional market detail, Timo Hiekkaranta, vp South America, release and label papers, for Ahlstrom, looked at this developing market, where self adhesive labelstock is showing one of the highest growth rates in the whole world, and which he described as “a solid, excellent base” for the whole labelstock manufacture and converting supply chain.

Film release liner trends were the topic addressed by John C Forster, vp, corporate development, for Flexcon. Growing in the roll label market at 5-6 per cent per annum, film release liner is adapting to market needs in many ways. Reduced caliper, low extractable silicone systems and silicone free release systems, recyclability, two-sides coated, and modifications to the back side of the liner are some of the areas where there are developments today. However, silicone transfer to the print surface, and the relationship between film tension and heat, remain problem areas. “Flexcon would like to see these addressed”, he said.

Technical developments

According to Hervé Vigny, director of Label Experts, an independent advisory laboratory for end users and converters in the self adhesive label industry, “Release liner is the most important factor in creating a self adhesive material, more so, than the adhesive itself”. He discussed the relationship between the laminate components and their influence on adhesive properties, and the so-called 'zippy release' phenomenon, which can result from an excess of platinum in the silicone layer after curing, or a high level of modulator in the silicone formulation.

“How much silicone do you need?”, asked Dr Hans Lautenschlager, innovation manager for Wacker Chemie. There is no single answer: film or paper release base, application, and substrate are all factors that affect silicone coat weight. He looked at performance requirements in terms of release, cure speed, and smoothness, and showed how new silicone systems can offer an improved cost/performance ratio using lower viscosity for improved coverage or adjusted shear viscosity to cope with varying coater speeds.

Drivers for the release coating industry remain a delicate balance between quality, performance and cost reduction. Karsten Schlichter, global market manager for Bluestar Silicones, looked at curing chemistry, comparing the various systems and their place in an industry where release base downgauging and the need for greener solutions in reduced VOCs and toxicity, and increased recyclability are growing trends.

Thomas E Hohenwarter Jr, of THresource looked at the healthy prospects for radiation curable release coatings. With 20 years' experience behind it, radiation curing has proved itself, he said, “here to stay”, and he predicted continuing double digit global growth for this robust combination of chemistry and technology.

Papers remain, globally, the release base of choice, and for good reasons, said Antti Heimola, director, technical marketing, for UPM-Kymmene. Paper based release liners can fulfil the requirements of everyone in the value chain for self adhesive labelstock in terms of quality and efficiency, he added.

Ismo Pietari, research and development director, UPM Raflatac, drilled down into these positive opportunities for paper liner and paper's many benefits, and the challenges in the label market that it faces from films, other labelling and product decoration techniques, waste directives, and linerless labelstock. He was uncompromising in his assessment of the future. “Filmic liner will gain market share in more demanding applications if paper suppliers don't provide more innovative solutions,” he predicted. He was confident that paper would remain the prime choice for partnering paper facestocks, and that environmental aspects would continue to favour papers.

In the self adhesive graphic arts market, CCK liners are the prime choice for today's leading wide format inkjet print technologies in partnership primarily with monomeric and polymeric cast and calendered vinyl films. Astrid Beckhaus, business line manager, graphic arts, for Cham Paper Group, showed how the quality of the print results achieved in this visually demanding market are influenced by all the components of the laminate - liner, siliconization, adhesive, and face material. Astrid Beckhaus said that the physical characteristics of clay coated krafts make them the best option for high impact graphics, and they do not suffer from the problems of silicone transfer to the face vinyl, which can be encountered with other liners.

With so many concerns addressed and new technologies analyzed, this year’s conference was considered to be a grand success. Next year, the Global Release Liner Conference will be held in Washington, DC, USA.

| Contacts |

| AWA Conferences & Events |