Release liners: the challenges ahead

19 March 2012Ann Hirst Smith provides an overview of the key topics of discussion at the recent global release liner industry conference, organised by AWA Conferences and Events, in Amsterdam

Keynote presentations at the conference addressed the industry status quo in the context of the global economy. Carsten Lange, MD release liner, coatings and consumer packaging, for Mondi, discussed the macro-economic outlook for the release liner industry.

In the longer term, he observed, it will be countries to the east of Europe and in Latin America that will evidence the greatest growth. In the current financial climate, Austria, Belgium and Germany are faring best in Europe – but consumer confidence is declining, and in this “second recession”, neither governments nor banks are in as good shape as they were in 2008. The Eurozone, he observed, may represent only 25% of the global economy – but China exports 25% of its GDP to Europe. With European manufacturing capacity in the merchant release liner business increasing between 2010 and 2013 by 15-16% (not all of it aimed at the European market), Lange observed: “We have to understand and manage capacity very carefully”.

The global economy

In a refreshingly clear and direct examination of the different financial markets around the world, John Graham, partner in Amsterdam-based Graham, Smith & Partners International Tax Counsel, discussed the subject in three ways – namely via the traditional, philosophical, and media-influenced approaches.

He highlighted the stagnant Japanese market; the USA, which, he said, has not dealt with any of its financial issues yet (and will not do so before the elections); the BRIC countries – which still have their own problems; and, of course, Europe and the euro – which was hailed in 2008 by the EU commissioner for economic and monetary affairs as a “major success” and a “pool of stability for the global economy”.

Release liner industry survey

Corey Reardon, president and CEO of AWA, presented the findings of the 2012 AWA release liner industry survey, peopled with around 100 responses from industry participants around the world. Sentiment has changed in the last year: more companies consider themselves to be regional rather than global, though most expect to see true globalisation within five years, and most, he said, believe that “being global provides opportunities for growth”.

Mergers and acquisitions within the value chain will also continue. Costs have increased dramatically – even over the prior year, which itself experienced tremendous cost pressures.

Looking forward, Reardon said: “Costs are still expected to rise, but at a slightly lower rate.” Inventory pressures remained an issue in 2011, as they had in 2010.

Research data

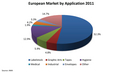

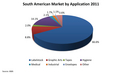

AWA Alexander Watson Associates’ research data reveals that in terms of materials and markets, glassine/calendered kraft papers still represent a solid 41% of the overall market, with film taking 12%. Pressure-sensitive labelstock remains the largest segment, at 51%.

Reardon predicted: “In this market, 40-60% of liner usage for primary product labelling will migrate to film in the next five years.” He added that variable information print (50% of the label market for release liner) will, however, always remain paper-based.

Geographically, North America retains the largest share of the 35,254 million m2 global market for release liner, although Europe and Asia Pacific are nearly equal.

North America is more optimistic about its growth opportunities in 2012 – predicting 5% plus growth, as does Asia Pacific – than South America, which anticipates 2-5% growth, and Europe, which expects 0-2% growth. Overall, growth has slowed, but Asia Pacific remains the growth leader and will, said Reardon, “take over as the main region in the near future”.

Heineken’s perspective

The beer market has been one of the success stories for pressure-sensitive labels in recent years, and delegates were able to share Heineken’s perspective on the release liner industry, as presented by the company’s global category buyer for packaging materials, Dennis Bakx.

“The consumer is changing his consumption pattern: people spend money in a different way today,” he said. The beer market is no exception. Demand is moving away from dispensed drinks in bars to home consumption, both using bottles and cans – and this has had a positive effect on Heineken’s use of pressure-sensitive labels.

Heineken chooses pressure-sensitive labels because, said Bakx, they support the company’s international brand (communicate by packaging) by adding value for both the retailer and consumer, and also deliver a practical advantage – high packaging line speeds.

But Heineken also has a ‘wish list’, and delegates were challenged to contribute to further improving release liners on pressure-sensitive labelstock. “What will be the next generation?”, Bakx asked. Reduced liner thickness/downgauging and linerless labels are possible future options, and innovation and sustainability are, of course, key factors. “About 40% of the pressure-sensitive product we buy is waste! My job is to reduce or optimise!”

Recycling initiatives

Release liner recycling initiatives from the label industry were the subject of the presentation from Mark Macaré, public affairs manager of the European pressure-sensitive label association, FINAT. Outlining the political and corporate drivers of action in this arena, he went on to detail the use of secondary materials in the label chain, recycling ‘bottlenecks’, and FINAT’s role in supporting and promoting industry initiatives. Macaré said that “70% of brand owners identify sustainability as a competitive advantage”, and ‘green’ initiatives by both brand owners and retailers are having a significant impact on overall awareness of the key sustainability issues. In the past year, FINAT has established a recycling project group, and is actively promoting and raising the awareness of the importance of recycling for the label industry, as well as positively demonstrating the suitability of siliconised paper liner for paper recycling.

FINAT is a signatory to the European Declaration on Paper Recovery. The association’s sustainability action agenda is wide-ranging. Macaré indicated that release liner – the highest priority – and pressure-sensitive label matrix and set-up waste are key areas where the association is concerned to identify and promote secondary materials/recycling solutions. He said that establishing an active industry network and developing and maintaining a database/catalogue, as well as setting upeffective communications across the value chain and the media (including success stories) are also prime objectives.

FINAT awaits the finalisation of the latest revision to the EU Packaging and Packaging Waste Directive, to learn whether label release liner will be defined as process waste or packaging waste.

Panel discussion

A panel comprising Christian Velasquez of Dow Corning, Mikko Meyder of Evonik Goldschmidt and Sean Duffy of Bluestar Silicones, and moderated by Corey Reardon, agreed that thinner, lighter, more stable substrates for release liner are needed, but that, as Velasquez remarked: “We have to be able to sell ourselves on the total value of the self-adhesive label, not just the release liner.” On the topic of film liner, Duffy observed that: “In cost terms, the option of choosing a film liner versus a paper liner now makes economic sense.” Substrate-identical label constructions – a PP liner on a PP facestock, he said, offer huge advantages in terms of recyclability.

Among other topics addressed were the limited success of non-traditional substrates such as PLA films; the future role of solvent siliconisation; increasing in-line siliconisation by pressure-sensitive laminators, as well as siliconisation/lamination at the converter stage; and the high cost of raw materials.

Innovative optical inspection and measurement systems for in-line quality and process control for film release liner production were the topic of the paper presented by Dr Schenk Industriemesstechnik’s senior business development manager, Hans Oerley. The advantages of automatic inspection over human inspectors, he showed, are considerable. Defects and irregularities are often invisible to the human eye, especially at high web speeds; human inspection cannot continue consistently for 24-hour periods; and automatic inspection can not only deliver process optimisation through fast feedback of data, but also provide archival information on defects.

The company says its EasyInspect and EasyMeasure systems offer flexible, leading-edge solutions for release liner production,

Linerless labels?

AWA’s Jackie Marolda explored the renewed challenges of linerless pressure-sensitive labels. The drivers for a move to linerless labels are the desire to reduce/eliminate waste; legislation; the cost of release liner; and the economics of liner waste. The AWA release liner survey 2012, she showed, identified interesting current sentiment. Involvement in recycling/re-use programmes has hardly grown at all.

“We’re all talking about it,” Marolda said, “but it’s all very future orientated.” Conversely, survey respondents identified linerless labels as an area where they expect to see innovation – and market substitution – in the near term. Linerless labels today have their limitations – label shape (though clear film labels can bear a printed shape), material supply, application machinery (here, Europe is ahead of North America), and application speeds. But they have clearly already found a niche in today’s market. Marolda said that, additionally, there are developments in facestocks, activatable adhesives, and printable silicone coatings. There are also developments in application equipment – hybrid machines capable of applying both traditional and linerless pressure-sensitive labels – and in converting equipment, allowing for radius-cornered labels and shaped perforations.

Direct-to-product

Digital inkjet printing, direct to the product, is now a reality – and potentially a major disrupter for the traditional label industry. Clayton Sampson, MD of Cyan Tec, demonstrated how his company’s inkjet printers, laser systems and robot automation can deliver single-pass printing for markets including aerospace, automotive, consumer products, electronics, food packaging, medical devices, and textiles. The technology offers short run and variable data capabilities, prints on uneven surfaces and complex shapes, and requires no makeready time. It has far-reaching strategic implications for traceability and anti-counterfeiting, particularly in pharmaceutical packaging, and mass customisation of consumer products.

Drying system

Gene Plavnik, president Heat Technologies, posited another challenge to traditional, established thinking in the release liner industry. His company’s US-patented, proven Spectra HE ultra drying system employs advanced convective heat and mass transfer technology – drying, curing, cooling, and heating – enhanced by strong acoustic oscillations. In projects involving coating, converting, and other in-line processes, Plavnik showed how a 50 inch long drying unit using Spectra HE technology can replace a traditional 56ft dryer, and will use only 13% of the energy consumed by its predecessor. Heat Technologies offers complete design and manufacturing for a variety of projects.

A brief supplier innovation forum featuring Billerud, Dow Corning, Dow Chemical, Dr Schenk, and Loparex, rounded off the conference agenda.

AWA Conferences & Events will hold the annual Label Release Liner Seminar in Chicago, USA, 10 September 2012.

Delegates at this year’s AWA-organised global release liner conference in Amsterdam AWA Asian Market European Market North American South American Worldwide External weblinksConverting Today is not responsible for the content of external internet sites.AWA